Unlock the power of stablecoins for your fintech

Trusted by the best

Until now, it was impossible for fintechs to launch stablecoin backed payment products.

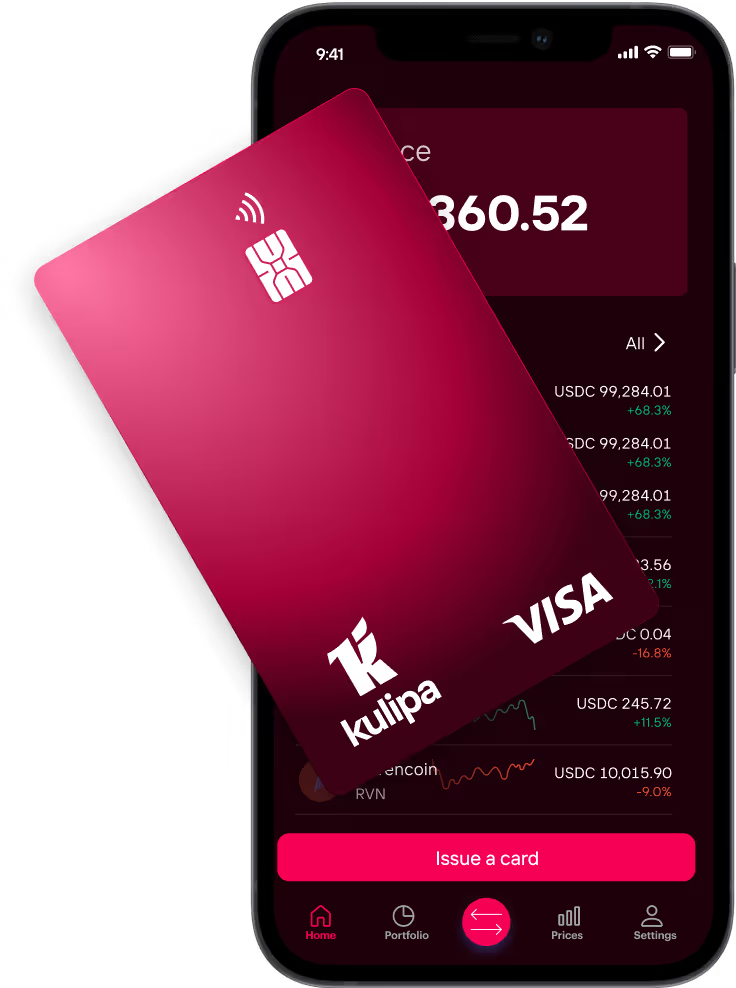

Kulipa makes this a reality.

Launch white-labelled payment cards, virtual accounts and wallets all compatible with stablecoins.

Bring mainstream payment to your platform

Become top of mind

Foster user engagement

Grow activity in your wallet

Our card management platform

Become top of mind

Foster user engagement

Grow activity in your wallet

With our card management platform

The crypto payment card wallets have been waiting for

White-labelled

API-powered

Out of the box

Tailored to phones

Frictionless

Customizable

Unlock new use cases with the power of stablecoin cards

Launch a comprehensive banking solution with instant settlement and card issuance, ATM access, and global coverage.

Provide users with a customized debit or prepaid card to spend their stablecoins anywhere Mastercard & Visa are accepted.

Create other services on top of the card (cashback, incentive and referral programs) to grow engagement even further.

The stablecoin payment plaform

fintechs have been waiting for

Payments and blockchain integrations are complex. We've partnered with industry leaders to make it simple.

And it’s only four steps away

Ready bet on Kulipa to bring state-of-the-art debit cards to their 2 million users, getting closer to bringing stablecoin benefits to a billion people worldwide.

Watch the full interview with Itamar, Ready’s CEO, to understand how Kulipa helped design their ideal crypto card product.

Blog of Kulipa

The Kulipa Advantage: How we run a true self-custodial debit card

In the traditional banking world (TradFi), "custody" is simple: you give your money to a bank, and they control it. Because they hold the keys, authorizing a card swipe is instantaneous and risk free.

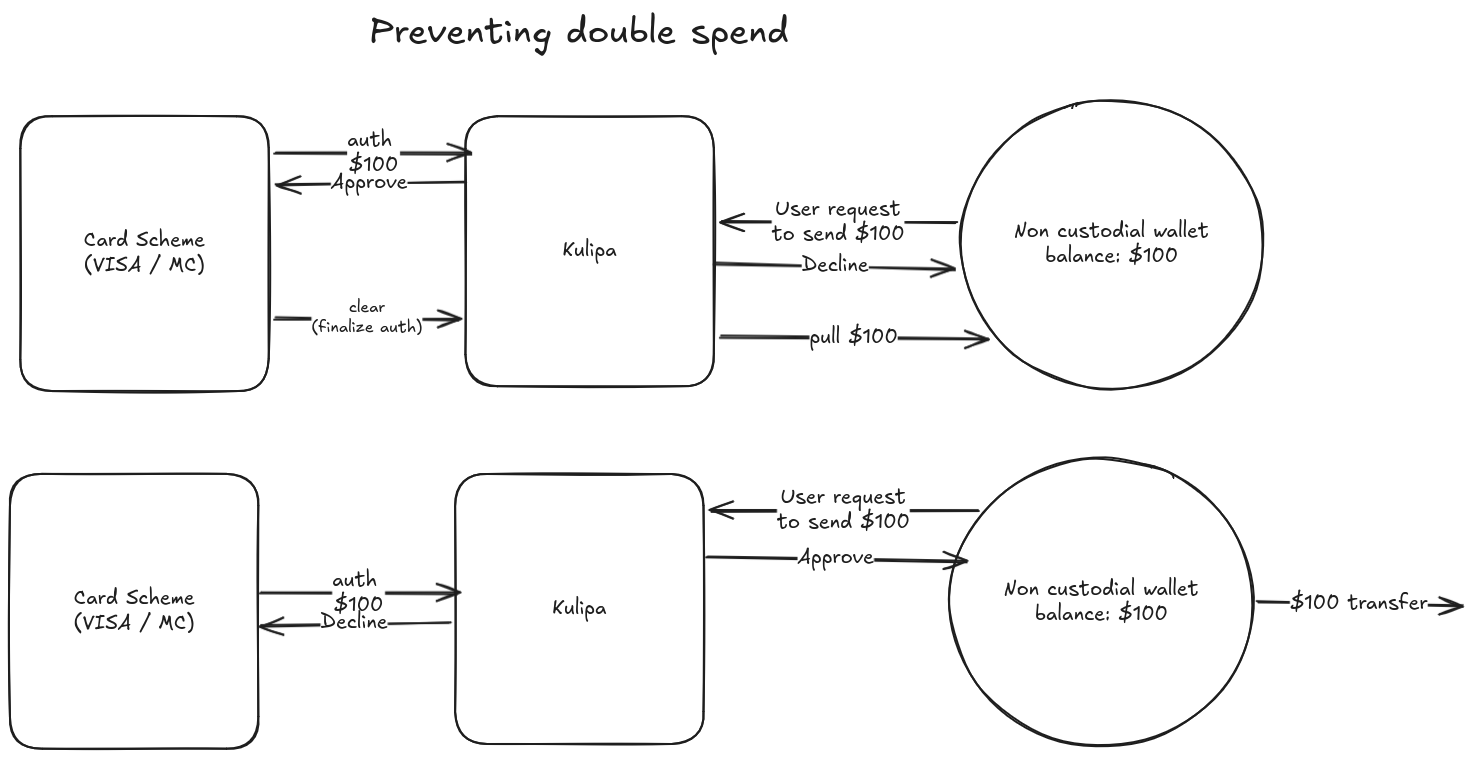

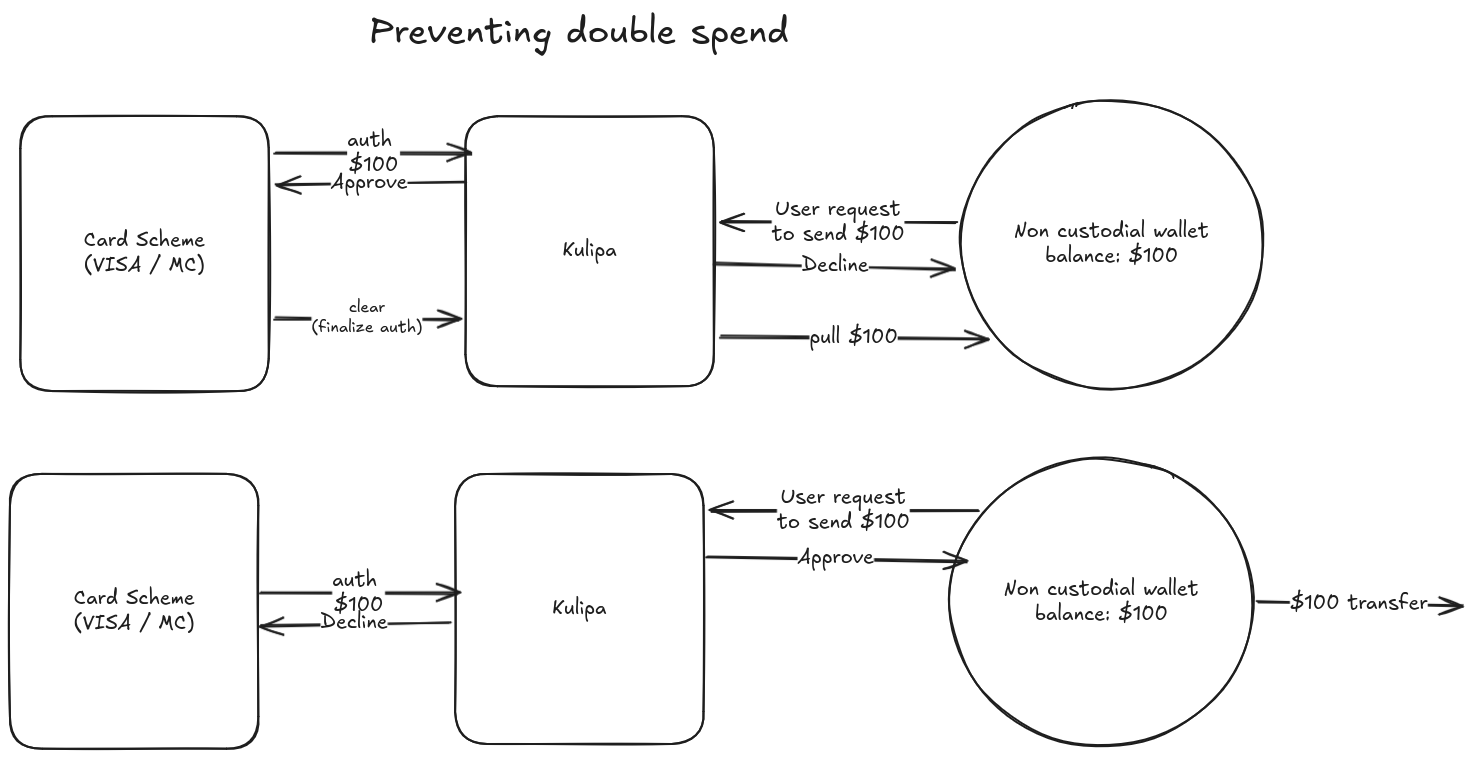

Self-custody on the blockchain, however, leaves the user in full control of their funds. It is therefore much more challenging to operate a card product against such a backdrop: a spend on the card needs to be approved within 3 seconds or less, usually too fast for a blockchain transaction to finalize. Without a clever solution, a user could double-spend: authorize a card purchase whilst moving their funds elsewhere, meaning the merchant can’t collect.

Existing solutions on the market

Most crypto card operators resort to one of three friction-heavy solutions:

- Prefunded: The user deposits card funds into a separate wallet. Many self proclaimed “debit” cards actually require this top-up deposit, and therefore behave like prepaid ones.

- Note: Kulipa also offers prefunded, as it is easy, safe and quick to integrate for clients starting out with cards.

- Time delay: Through a smart contract account, any user action is delayed by a few minutes, whereas the card operator can withdraw funds instantly, preventing double spend.

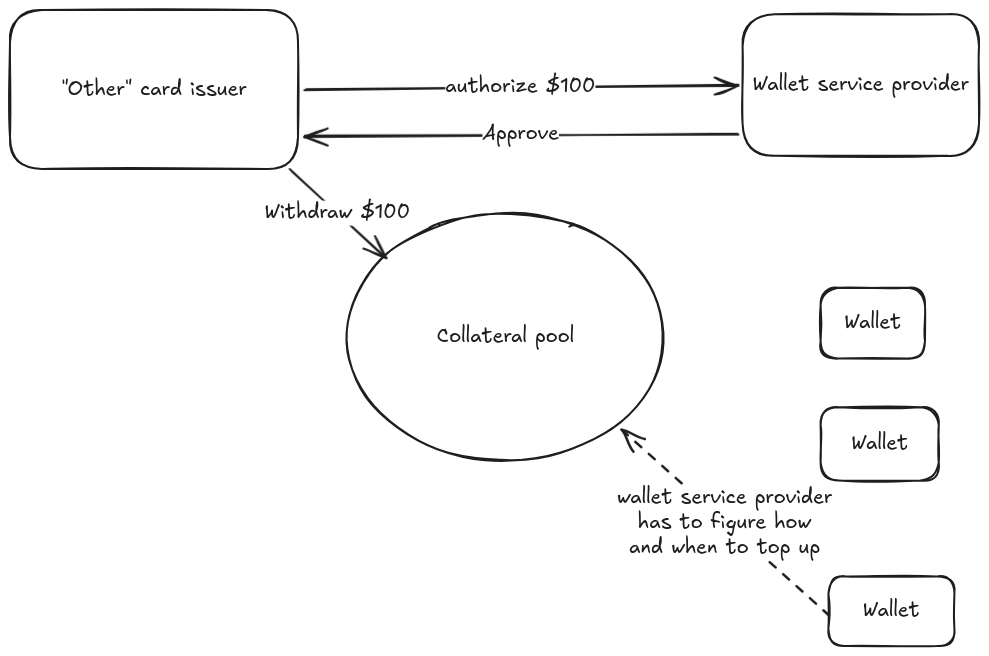

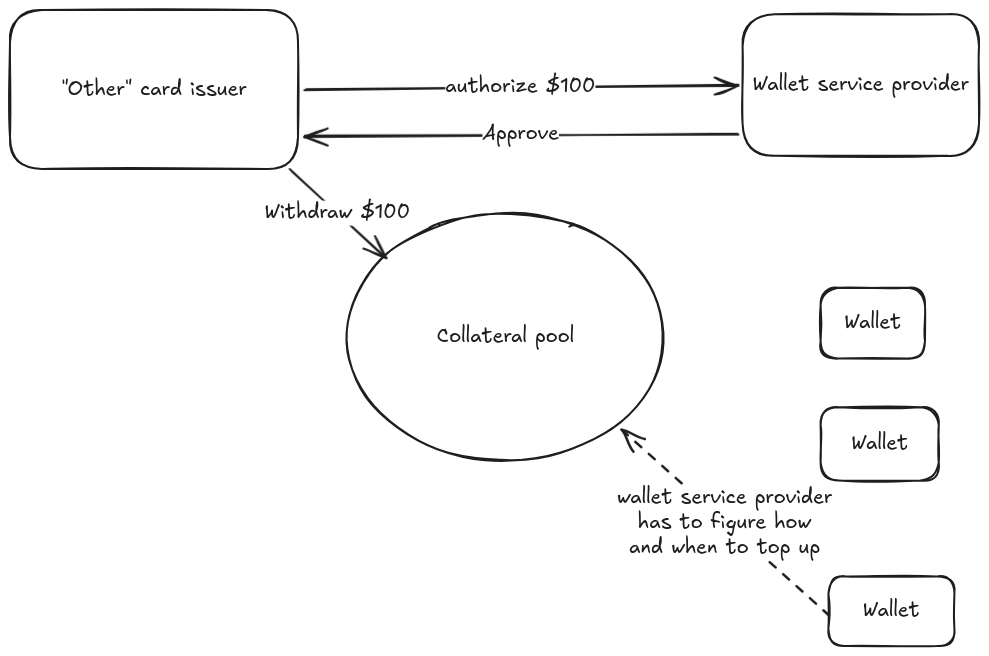

- Collateral Management: other issuers offload risk and technical debt onto the wallet provider by requiring them to handle all card scheme events, post a large, capital-inefficient collateral pool of their own funds to back user swipes , and then assume the "recovery risk" of collecting those funds back from the user’s self-custodial wallet.Essentially this forces the wallet provider to act as a de-facto bank building and maintaining complex, risky logic.

Kulipa provides superior UX and integration

Kulipa eliminates the need for collateral and pre-funding, using two proprietary integration methods that keep the user in control while maintaining "fiat-speed" authorizations.

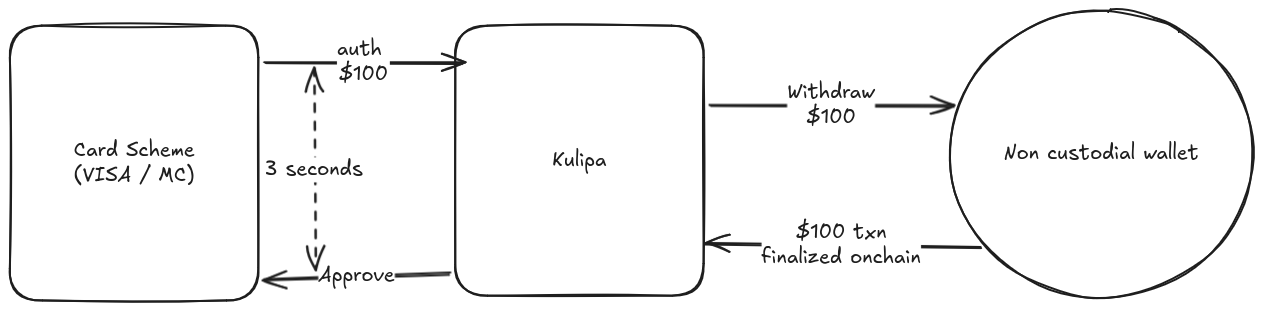

Just-In-Time Approval (JIT)

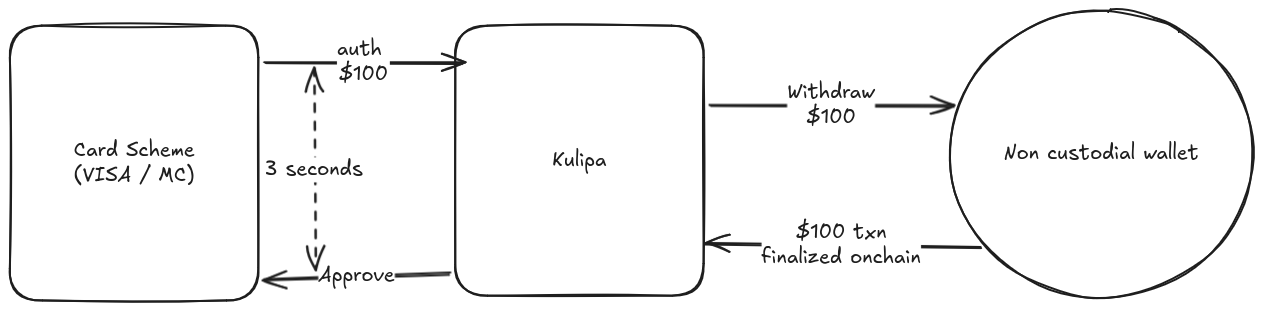

The most natural approach to running a debit card would be to try and collect funds at the time of authorization. This is a straightforward approach: request funds when a card authorization request is made. If the transaction finalizes within the authorization time window, approve the card authorization, otherwise decline.

This approach is very simple, and can work with any wallet type: EOA, account abstraction, MPC, etc.

It requires a fast chain (such as Avalanche) with block times well below 1s. Even with such chains, network congestion, gas pricing policy, and other factors, could contribute to some transactions failing, so some care has to be taken to ensure consistent landing of transactions on chain.

Cooperative Approval

For the ultimate balance of security and efficiency, Kulipa acts as a limited-power co-signer. The user invites Kulipa to their wallet and grants it specific, narrow permissions:

- Can collect (up to a certain amount) in the settlement token (e.g. USDC).

- mandatory co-signer for any transactions performed in the settlement token (e.g. any USDC transfers out or allowance setups).

- mandatory co-signer on any change of signers - except if the user wants to remove Kulipa itself as a co-signer.

- If the user wants to remove Kulipa as a co-signer, there is a time delay for that action, which allows Kulipa to settle the accounts before being evicted as a co-signer.

This type of setup can be achieved in certain account abstraction wallets (such as SAFE), MPC signing schemes, TEE signing schemes, and generally whenever there is a co-signer / policy signer environment.

With this setup, some additional advantages can be achieved:

- Enhanced privacy: Card activity is not reflected 1:1 on-chain. There is only one settlement happening per day, rather than a collection every time the card is being used.

- Gas efficiency: A single transaction per wallet, per day, vs tens or hundreds of back-and-forth transactions, leads to much better gas efficiency.

- High reliability: Since the settlement is not bound to any time frame, the reliability of card payments being approved is maximal.

This setup retains self custody because the user is in control: The user is the one to invite Kulipa to the wallet, grant it certain powers, and can at any time remove Kulipa (under the exit conditions agreed upon at time of invitation).

Summary: Kulipa offerings

In the traditional banking world (TradFi), "custody" is simple: you give your money to a bank, and they control it. Because they hold the keys, authorizing a card swipe is instantaneous and risk free.

Self-custody on the blockchain, however, leaves the user in full control of their funds. It is therefore much more challenging to operate a card product against such a backdrop: a spend on the card needs to be approved within 3 seconds or less, usually too fast for a blockchain transaction to finalize. Without a clever solution, a user could double-spend: authorize a card purchase whilst moving their funds elsewhere, meaning the merchant can’t collect.

Existing solutions on the market

Most crypto card operators resort to one of three friction-heavy solutions:

- Prefunded: The user deposits card funds into a separate wallet. Many self proclaimed “debit” cards actually require this top-up deposit, and therefore behave like prepaid ones.

- Note: Kulipa also offers prefunded, as it is easy, safe and quick to integrate for clients starting out with cards.

- Time delay: Through a smart contract account, any user action is delayed by a few minutes, whereas the card operator can withdraw funds instantly, preventing double spend.

- Collateral Management: other issuers offload risk and technical debt onto the wallet provider by requiring them to handle all card scheme events, post a large, capital-inefficient collateral pool of their own funds to back user swipes , and then assume the "recovery risk" of collecting those funds back from the user’s self-custodial wallet.Essentially this forces the wallet provider to act as a de-facto bank building and maintaining complex, risky logic.

Kulipa provides superior UX and integration

Kulipa eliminates the need for collateral and pre-funding, using two proprietary integration methods that keep the user in control while maintaining "fiat-speed" authorizations.

Just-In-Time Approval (JIT)

The most natural approach to running a debit card would be to try and collect funds at the time of authorization. This is a straightforward approach: request funds when a card authorization request is made. If the transaction finalizes within the authorization time window, approve the card authorization, otherwise decline.

This approach is very simple, and can work with any wallet type: EOA, account abstraction, MPC, etc.

It requires a fast chain (such as Avalanche) with block times well below 1s. Even with such chains, network congestion, gas pricing policy, and other factors, could contribute to some transactions failing, so some care has to be taken to ensure consistent landing of transactions on chain.

Cooperative Approval

For the ultimate balance of security and efficiency, Kulipa acts as a limited-power co-signer. The user invites Kulipa to their wallet and grants it specific, narrow permissions:

- Can collect (up to a certain amount) in the settlement token (e.g. USDC).

- mandatory co-signer for any transactions performed in the settlement token (e.g. any USDC transfers out or allowance setups).

- mandatory co-signer on any change of signers - except if the user wants to remove Kulipa itself as a co-signer.

- If the user wants to remove Kulipa as a co-signer, there is a time delay for that action, which allows Kulipa to settle the accounts before being evicted as a co-signer.

This type of setup can be achieved in certain account abstraction wallets (such as SAFE), MPC signing schemes, TEE signing schemes, and generally whenever there is a co-signer / policy signer environment.

With this setup, some additional advantages can be achieved:

- Enhanced privacy: Card activity is not reflected 1:1 on-chain. There is only one settlement happening per day, rather than a collection every time the card is being used.

- Gas efficiency: A single transaction per wallet, per day, vs tens or hundreds of back-and-forth transactions, leads to much better gas efficiency.

- High reliability: Since the settlement is not bound to any time frame, the reliability of card payments being approved is maximal.

This setup retains self custody because the user is in control: The user is the one to invite Kulipa to the wallet, grant it certain powers, and can at any time remove Kulipa (under the exit conditions agreed upon at time of invitation).

Summary: Kulipa offerings

Authentication in blockchains - a layman’s guide

As the blockchain ecosystem matures, better and more diversified ways of authenticating for blockchain transactions have emerged. This can be quite overwhelming to newcomers, and so this post aims to put order in the following terms:

- EOA

- MPC

- Account abstraction

- Paymaster

- Relay

- Key abstraction

EOA

EOA stands for Externally Owner Account. This is typically the simplest and original form of authentication: An end user creates a unique, secret, private key which can be held in an app (such as Metamask and Solflare) or better secured on a hardware wallet (such as Ledger). With that private key the user derives or creates an account on the blockchain. All transactions submitted to the that blockchain account, must be signed with the private key.

EOA private keys are often stored as a “seed phrase”: A series of words from which the private key can be derived.

EOA authentication is the only built-in authentication mechanism which most blockchains (including Ethereum) recognize. All the other methods detailed below build on top or around the EOA method in order to provide additional benefits.

.png)

MPC

MPC stands for Multi Party Computation. It is a technology that allows a private key to be split up into parts (shards) such that the holders of several shards can together produce a valid signature of the private key, regardless of which shards are being used. For example, a private key could be split into 5 shards such that any 2 shards could sign a transaction. This would be annotated a 2/5 scheme - 2 signers needed out of a total of 5. Any 2 shards could be used to sign a transaction with the private key.

MPC has many uses - in this article we will consider the case that a private key is sharded and used to control an EOA. This can be very useful for a variety of cases:

- The account is owned by more than one person (e.g. a company) and every transaction needs to be validated by several people

- A user is worried about losing access to their account; they could store additional shards as backups, such that even if one shard is compromised, it will not risk the account being compromised

- One or more of the signing shards would be owned by an automated service that would enforce policies on the account. For example, if an account has $1m in assets, the policy could prevent sending all of that amount, instead allowing only $10k to be sent out on any given day

Examples of MPC-based platforms include Fireblocks, a wallet infrastructure service, and Zengo, a non-custodial wallet.

While MPC is very useful for securing accounts, it still requires all related users to hold a shard with a very specific and technically involved signing scheme. For instance, each of these shards would likely require a “seed phrase” to be memorized and input into an app, in order to sign payloads.

.png)

Account Abstraction

The best user experience for authentication should resemble the one users are already accustomed to. Users typically use usernames and passwords, sign in with Google/Apple, have 2FA (2-factor authentication) methods set up, and more recently leverage passkeys. Account abstraction aims to allow users to continue using all of these options.

Instead of using an EOA account that must use a specific signature, the user could deploy a smart contract that would serve as their account. The smart contract is set up to validate a given authentication, such as sign-in with Google.

Sign-in with Google (and all the other authentication methods) can be used to sign transactions. The smart contract will accept any transaction, verify its signature, and if valid - will execute it.

This greatly improves authentication experience for end-users. However, blockchains like Ethereum do not have a concept of calling externally into a smart contract. There always needs to be an initial signed transaction from an EOA. That EOA also needs to pay the computation fee (”gas”) of the transaction - so account abstraction transactions cannot be submitted from outside the blockchain.

To solve that, we need some service to submit these transactions on our behalf, which we call a relay.

Relay & Paymaster

A relay accepts a transaction and executes it on behalf of another party. Typically, relays will ask for a small fee for that service. The relay usually also want to claim back gas fees, which can be paid back to them by the user, or the user might have a service they top up with gas to be used by the relay for the execution, called a Paymaster.

Two important notes about the operation of relays:

- A relay cannot change the user’s transaction. There is very little risk giving the transaction to the relay, since it is signed by the user. Any attempt to change the transaction will invalidate the signature, and the relay is not able to authenticate with the user’s credentials in order to re-sign the transaction. The only risk a relay can pose is by not submitting the transaction (often called censoring the user).

- A relay can use any EOA to submit this transaction. The EOA itself does not need to be known to the user’s account abstraction contract. That smart contract will accept a call from anyone, as long as a signed payload is provided.

.png)

Key abstraction

A lesser-known concept, but important to understand, is key abstraction. It is an alternative to account abstraction.

While account abstraction is an immense improvement in the UX, it is not very efficient because more processing happens onchain, consuming more gas. Furthermore, some on-chain services, especially on Ethereum, do not work well with account abstraction contracts for technical reasons.

It would have been nice if there was a way to use sign-in with Google (or any other auth method) in order to operate an EOA account. Some newer blockchains actually allow that, but even for the existing ones, there is a solution in the form of key abstraction platforms.

A key abstraction platform will securely store an EOA private key, and only allow access to it via another authentication method (such as sign-in with Google). This means the user authenticates the way they want, and under the hood that signature could be replaced with an EOA-compatible signature in order to submit the transaction.

But how can the a platform “securely store” the EOA private key without risking it falling in the wrong hands?

One way to do that is to use TEE (trusted execution environments). These are containers hosted in a very specific way (such as Amazon Nitro containers) that verify that they match exactly some pre-vetted container image and cannot be changed. The user can then push a private key into such a container as well as whichever other authentication methods they wish to use, and the container, if set up correctly, will perform this service for them, without leaking any other data outside.

Such platforms already exist - such as Privy or Turnkey.

Side note: key abstraction is closely related to the terms embedded wallet and wallet as a service. We plan to explore these terms and clarify them in a future post.

.png)

Final word

We hope this article helped clarify the different components from which a blockchain account system could be built. Do notice that these are not “either-or” solutions. In some cases different components can be used together in one solution.

For instance, MPC and key abstraction can be combined in different ways to create different types of products. The shards of an MPC can each be stored in a key abstraction platform, so that the result is an MPC account, but the authentication is done in whatever method the users want. This can be desirable when operating a shared wallet, or when operating a single-user wallet but not wanting to trust a single TEE with a full signing key.

This space keeps evolving and blockchains are building better authentication primitives to allow for better solutions. We will continue to follow the trends and update you!

As the blockchain ecosystem matures, better and more diversified ways of authenticating for blockchain transactions have emerged. This can be quite overwhelming to newcomers, and so this post aims to put order in the following terms:

- EOA

- MPC

- Account abstraction

- Paymaster

- Relay

- Key abstraction

EOA

EOA stands for Externally Owner Account. This is typically the simplest and original form of authentication: An end user creates a unique, secret, private key which can be held in an app (such as Metamask and Solflare) or better secured on a hardware wallet (such as Ledger). With that private key the user derives or creates an account on the blockchain. All transactions submitted to the that blockchain account, must be signed with the private key.

EOA private keys are often stored as a “seed phrase”: A series of words from which the private key can be derived.

EOA authentication is the only built-in authentication mechanism which most blockchains (including Ethereum) recognize. All the other methods detailed below build on top or around the EOA method in order to provide additional benefits.

.png)

MPC

MPC stands for Multi Party Computation. It is a technology that allows a private key to be split up into parts (shards) such that the holders of several shards can together produce a valid signature of the private key, regardless of which shards are being used. For example, a private key could be split into 5 shards such that any 2 shards could sign a transaction. This would be annotated a 2/5 scheme - 2 signers needed out of a total of 5. Any 2 shards could be used to sign a transaction with the private key.

MPC has many uses - in this article we will consider the case that a private key is sharded and used to control an EOA. This can be very useful for a variety of cases:

- The account is owned by more than one person (e.g. a company) and every transaction needs to be validated by several people

- A user is worried about losing access to their account; they could store additional shards as backups, such that even if one shard is compromised, it will not risk the account being compromised

- One or more of the signing shards would be owned by an automated service that would enforce policies on the account. For example, if an account has $1m in assets, the policy could prevent sending all of that amount, instead allowing only $10k to be sent out on any given day

Examples of MPC-based platforms include Fireblocks, a wallet infrastructure service, and Zengo, a non-custodial wallet.

While MPC is very useful for securing accounts, it still requires all related users to hold a shard with a very specific and technically involved signing scheme. For instance, each of these shards would likely require a “seed phrase” to be memorized and input into an app, in order to sign payloads.

.png)

Account Abstraction

The best user experience for authentication should resemble the one users are already accustomed to. Users typically use usernames and passwords, sign in with Google/Apple, have 2FA (2-factor authentication) methods set up, and more recently leverage passkeys. Account abstraction aims to allow users to continue using all of these options.

Instead of using an EOA account that must use a specific signature, the user could deploy a smart contract that would serve as their account. The smart contract is set up to validate a given authentication, such as sign-in with Google.

Sign-in with Google (and all the other authentication methods) can be used to sign transactions. The smart contract will accept any transaction, verify its signature, and if valid - will execute it.

This greatly improves authentication experience for end-users. However, blockchains like Ethereum do not have a concept of calling externally into a smart contract. There always needs to be an initial signed transaction from an EOA. That EOA also needs to pay the computation fee (”gas”) of the transaction - so account abstraction transactions cannot be submitted from outside the blockchain.

To solve that, we need some service to submit these transactions on our behalf, which we call a relay.

Relay & Paymaster

A relay accepts a transaction and executes it on behalf of another party. Typically, relays will ask for a small fee for that service. The relay usually also want to claim back gas fees, which can be paid back to them by the user, or the user might have a service they top up with gas to be used by the relay for the execution, called a Paymaster.

Two important notes about the operation of relays:

- A relay cannot change the user’s transaction. There is very little risk giving the transaction to the relay, since it is signed by the user. Any attempt to change the transaction will invalidate the signature, and the relay is not able to authenticate with the user’s credentials in order to re-sign the transaction. The only risk a relay can pose is by not submitting the transaction (often called censoring the user).

- A relay can use any EOA to submit this transaction. The EOA itself does not need to be known to the user’s account abstraction contract. That smart contract will accept a call from anyone, as long as a signed payload is provided.

.png)

Key abstraction

A lesser-known concept, but important to understand, is key abstraction. It is an alternative to account abstraction.

While account abstraction is an immense improvement in the UX, it is not very efficient because more processing happens onchain, consuming more gas. Furthermore, some on-chain services, especially on Ethereum, do not work well with account abstraction contracts for technical reasons.

It would have been nice if there was a way to use sign-in with Google (or any other auth method) in order to operate an EOA account. Some newer blockchains actually allow that, but even for the existing ones, there is a solution in the form of key abstraction platforms.

A key abstraction platform will securely store an EOA private key, and only allow access to it via another authentication method (such as sign-in with Google). This means the user authenticates the way they want, and under the hood that signature could be replaced with an EOA-compatible signature in order to submit the transaction.

But how can the a platform “securely store” the EOA private key without risking it falling in the wrong hands?

One way to do that is to use TEE (trusted execution environments). These are containers hosted in a very specific way (such as Amazon Nitro containers) that verify that they match exactly some pre-vetted container image and cannot be changed. The user can then push a private key into such a container as well as whichever other authentication methods they wish to use, and the container, if set up correctly, will perform this service for them, without leaking any other data outside.

Such platforms already exist - such as Privy or Turnkey.

Side note: key abstraction is closely related to the terms embedded wallet and wallet as a service. We plan to explore these terms and clarify them in a future post.

.png)

Final word

We hope this article helped clarify the different components from which a blockchain account system could be built. Do notice that these are not “either-or” solutions. In some cases different components can be used together in one solution.

For instance, MPC and key abstraction can be combined in different ways to create different types of products. The shards of an MPC can each be stored in a key abstraction platform, so that the result is an MPC account, but the authentication is done in whatever method the users want. This can be desirable when operating a shared wallet, or when operating a single-user wallet but not wanting to trust a single TEE with a full signing key.

This space keeps evolving and blockchains are building better authentication primitives to allow for better solutions. We will continue to follow the trends and update you!

.png)

Regulatory Radar #4

The recent passage of the U.S. GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) has sent regulatory ripples across the Atlantic. As the U.S. takes a bold step toward stablecoin regulation, European officials are parsing its implications for the EU's digital finance strategy. This post summarizes the reactions from Brussels and other EU institutions, and what they could signal for the future of transatlantic crypto policy.

Brussels Watches Closely: Strategic Opportunity or Regulatory Risk?

Following the enactment of the GENIUS Act, which establishes a comprehensive framework for the issuance and oversight of U.S. dollar-backed stablecoins, EU officials have been quick to respond. While there’s a broad consensus that regulatory clarity is welcome, reactions across European institutions reflect a blend of strategic caution and competitive awareness.

- European Commission (EC) - Cautious Validation: EC officials welcomed the move in principle. A senior official from DG FISMA noted that the U.S. stablecoin law "reflects a long-overdue commitment to serious digital finance regulation," but cautioned that it may accelerate "regulatory arbitrage pressures in Europe."Internal Commission briefings reportedly highlighted that GENIUS "validates the core logic of MiCA" (the EU’s Markets in Crypto-Assets Regulation) by requiring reserve backing, redemption rights, and prudential oversight for stablecoins. However, there is some concern that the U.S. framework offers "greater operational flexibility" for issuers, which could attract new entrants to the American market.

- European Parliament (EP) - Split views : EP members of the Economic and Monetary Affairs (ECON) Committee were split. Some MEPs praised the GENIUS Act as an important move toward global regulatory convergence. Others, particularly from the Greens and center-left S&D groups, expressed fears that the U.S. might become "a permissive haven" for dollar-denominated stablecoins unless supervision is strictly enforced.

The GENIUS Act’s multi-issuance provisions — allowing both bank and non-bank entities to issue stablecoins under specific regulatory conditions — were noted with interest in Brussels. Some policymakers view this as a potential competitive advantage for the U.S. system, given MiCA’s more cautious approach to non-bank issuance.

The ECB Sounds the Alarm: dollarization risk

The most vocal critique came from the European Central Bank. ECB board member Piero Cipollone warned in a recent speech that the GENIUS Act could "turbocharge U.S. stablecoin issuance" and lead to "a gradual dollarization of European digital payments." He called for urgent coordination within the eurozone, saying the ECB must "not be caught off guard by a wave of dollar-linked assets outpacing the digital euro."

President Christine Lagarde echoed these concerns more diplomatically, stating that while the ECB supports responsible innovation, "the risk of monetary fragmentation is real if non-euro stablecoins dominate retail transactions in Europe."This has reignited debate over MiCA’s adequacy in ringfencing the eurozone against foreign digital currency inflows.

The Transatlantic Outlook: Divergence or Dialogue?

The passage of the GENIUS Act is already influencing how EU officials are thinking about future legislation. One tangible impact: renewed calls within the Commission to reassess MiCA’s thresholds on foreign stablecoin issuance. Some voices within the EC are urging a faster rollout of the digital euro to mitigate dependence on dollar-based tokens.

At the same time, there is cautious optimism that GENIUS might revive stalled talks around U.S.-EU cooperation on crypto supervision. European lawmakers have long pressed Washington to deliver a harmonized framework, and now that one exists for stablecoins, there may be momentum to align supervisory practices.

As one senior MEP put it: "MiCA was first. GENIUS is faster. The question now is: can we meet in the middle before market fragmentation gets worse?"

Final Take

The GENIUS Act’s passage marks a pivotal moment in the global race to regulate digital assets. For the EU, it brings both a challenge and an opportunity: to defend the integrity of its digital currency regime while leveraging this moment to deepen international cooperation. Whether the transatlantic stablecoin landscape will converge or diverge may depend as much on political will as on policy architecture.

Stay tuned for more insights in the next edition of Regulatory Radar!

The recent passage of the U.S. GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) has sent regulatory ripples across the Atlantic. As the U.S. takes a bold step toward stablecoin regulation, European officials are parsing its implications for the EU's digital finance strategy. This post summarizes the reactions from Brussels and other EU institutions, and what they could signal for the future of transatlantic crypto policy.

Brussels Watches Closely: Strategic Opportunity or Regulatory Risk?

Following the enactment of the GENIUS Act, which establishes a comprehensive framework for the issuance and oversight of U.S. dollar-backed stablecoins, EU officials have been quick to respond. While there’s a broad consensus that regulatory clarity is welcome, reactions across European institutions reflect a blend of strategic caution and competitive awareness.

- European Commission (EC) - Cautious Validation: EC officials welcomed the move in principle. A senior official from DG FISMA noted that the U.S. stablecoin law "reflects a long-overdue commitment to serious digital finance regulation," but cautioned that it may accelerate "regulatory arbitrage pressures in Europe."Internal Commission briefings reportedly highlighted that GENIUS "validates the core logic of MiCA" (the EU’s Markets in Crypto-Assets Regulation) by requiring reserve backing, redemption rights, and prudential oversight for stablecoins. However, there is some concern that the U.S. framework offers "greater operational flexibility" for issuers, which could attract new entrants to the American market.

- European Parliament (EP) - Split views : EP members of the Economic and Monetary Affairs (ECON) Committee were split. Some MEPs praised the GENIUS Act as an important move toward global regulatory convergence. Others, particularly from the Greens and center-left S&D groups, expressed fears that the U.S. might become "a permissive haven" for dollar-denominated stablecoins unless supervision is strictly enforced.

The GENIUS Act’s multi-issuance provisions — allowing both bank and non-bank entities to issue stablecoins under specific regulatory conditions — were noted with interest in Brussels. Some policymakers view this as a potential competitive advantage for the U.S. system, given MiCA’s more cautious approach to non-bank issuance.

The ECB Sounds the Alarm: dollarization risk

The most vocal critique came from the European Central Bank. ECB board member Piero Cipollone warned in a recent speech that the GENIUS Act could "turbocharge U.S. stablecoin issuance" and lead to "a gradual dollarization of European digital payments." He called for urgent coordination within the eurozone, saying the ECB must "not be caught off guard by a wave of dollar-linked assets outpacing the digital euro."

President Christine Lagarde echoed these concerns more diplomatically, stating that while the ECB supports responsible innovation, "the risk of monetary fragmentation is real if non-euro stablecoins dominate retail transactions in Europe."This has reignited debate over MiCA’s adequacy in ringfencing the eurozone against foreign digital currency inflows.

The Transatlantic Outlook: Divergence or Dialogue?

The passage of the GENIUS Act is already influencing how EU officials are thinking about future legislation. One tangible impact: renewed calls within the Commission to reassess MiCA’s thresholds on foreign stablecoin issuance. Some voices within the EC are urging a faster rollout of the digital euro to mitigate dependence on dollar-based tokens.

At the same time, there is cautious optimism that GENIUS might revive stalled talks around U.S.-EU cooperation on crypto supervision. European lawmakers have long pressed Washington to deliver a harmonized framework, and now that one exists for stablecoins, there may be momentum to align supervisory practices.

As one senior MEP put it: "MiCA was first. GENIUS is faster. The question now is: can we meet in the middle before market fragmentation gets worse?"

Final Take

The GENIUS Act’s passage marks a pivotal moment in the global race to regulate digital assets. For the EU, it brings both a challenge and an opportunity: to defend the integrity of its digital currency regime while leveraging this moment to deepen international cooperation. Whether the transatlantic stablecoin landscape will converge or diverge may depend as much on political will as on policy architecture.

Stay tuned for more insights in the next edition of Regulatory Radar!

Frequently asked questions

We're a one-stop-shop to help crypto wallet issue payment cards. These cards carry your brand, and offer best-in-class payment UX, a flexible API, and an intuitive dashboard to empower your support team.

We have 2 card products: a debit card and a prepaid card. Both let your users spend their crypto anywhere Mastercard and Visa are accepted.

With Kulipa, merchants don't need to accept crypto (or even know anything about it) for users to spend their holdings. We seamlessly convert USDC to fiat in the background, ensuring a smooth payment experience for all.

Anywhere Mastercard and Visa are accepted, Kulipa is, too! That means over 37 million establishments in 210 countries.

Whatever your wallet needs! Branded physical cards, Apple Pay®/ Google Pay™, or virtual cards for online purchases.

Kulipa takes security extremely seriously, using state-of-the-art measures to safeguard funds and data, so that users have peace of mind when spending their crypto. We work with a trusted network of partners to ensure maximum security for wallets and end users alike.

At this time, we support USDC, its wrapped versions, and Paxos. We can deploy on any blockchain - from EVM chains to L2 or Solana, and many more.